Table of Contents

1. Credit Score Kya Hai Aur Kyun Zaroori Hai ?

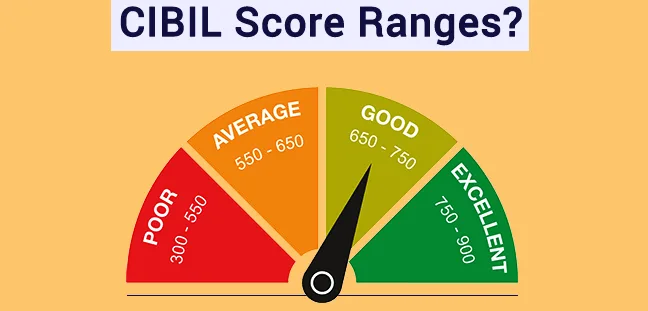

Credit score ek 3-digit number hota hai (300–900), jo batata hai ki aap kitne reliable borrower ho.

Good Score: 720+

Average: 650–719

Low/Poor: 649 se niche

👉 High score hone par:

Loan approval easy milta hai

Interest rate kam hota hai

Credit card limit aur offers achhe milte hain

2. Free Mein Credit Score Kaise Check Karein ?

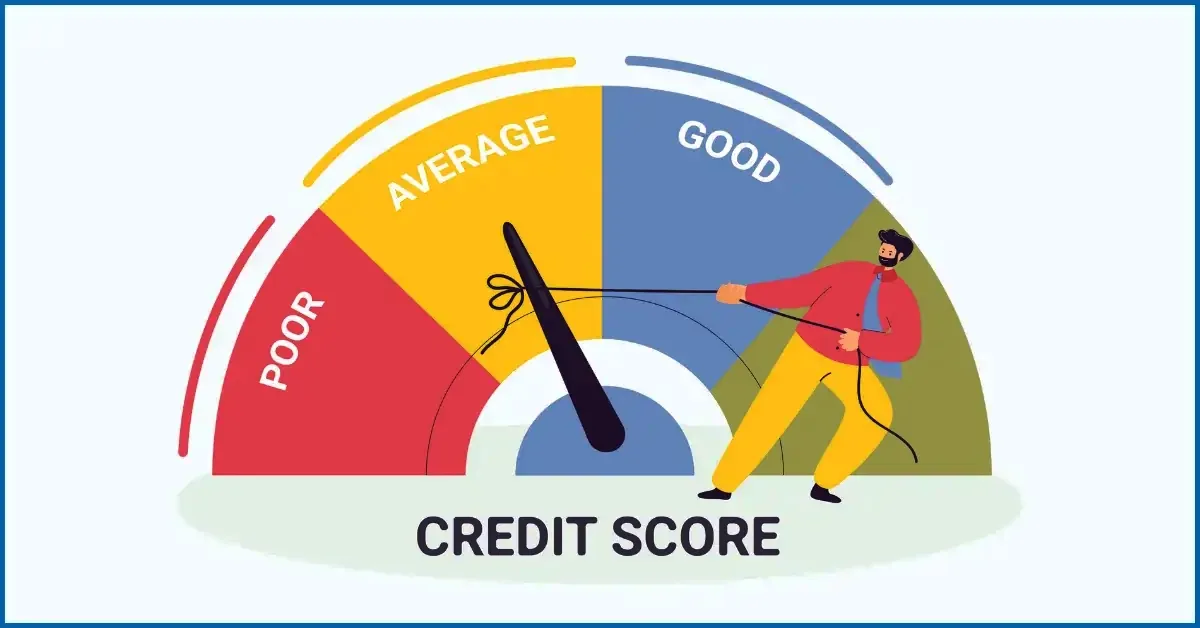

3. Agar Score Niche Gir Gaya Hai To Kya Karein ?

Sabse pehle credit report download karo aur samajho score girne ki wajah.

Late payments?

High credit utilization?

Multiple loan applications?

Ya koi galti report me?

Phir usko systematically fix karo.

4. On-Time Payment = Fastest Recovery.

Auto-debit set karo.

Har EMI/credit card bill time par do.

Delay hua toh kam se kam minimum due zaroor pay karo.

👉 Sirf 2–3 mahine ki consistent timely payments se score recover hona shuru ho jaata hai.

5. Credit Utilization Ratio (30% Rule)

Card ka limit 1 lakh hai toh ₹30,000 se zyada mat use karo.

Limit increase karwao.

Extra debts jaldi clear karo.

6. Debt Clearance Pe Focus Karo.

Pehle high-interest credit card dues clear karo.

Fir personal loans.

“Snowball Method” use karo – chhoti debts clear karke motivation lo, fir badi debts handle karo.

7. Credit Report Errors Fix Karo.

Report me galti ho toh bureaus ko dispute bhejo.

30 din me correction ho jaata hai.

8. Multiple Applications Se Bacho.

Har naye loan/credit card application par hard inquiry hoti hai.

Zyada applications = score aur girta hai.

9. Old Accounts Active Rakho.

Purane credit cards band mat karo.

Small spends rakho, full bill clear karo.

Purani credit history aapke score ke liye gold jaisi hoti hai.

Sirf credit card nahi, thoda secured loan (car/home) + unsecured loan bhi rakho.

Lekin unnecessary loan mat lo.

10. ⚠️ Companies Jo Paisa Lekar Credit Score Sudharne Ka Vaada Karti Hain.

Aajkal market me bohot “credit repair companies” hain jo paisa lekar aapka score improve karne ka solution deti hain.

👉 Reality Check:

Ye companies mainly aapka credit report errors dispute karti hain – jo aap khud bhi free me kar sakte ho.

Kuch companies debt settlement agencies hoti hain jo lenders se negotiation karti hain.

Lekin permanent solution sirf aapki khud ki financial discipline se aata hai.

💡 Pro Tip: Agar koi company aapse “instant score boost” ka wada kare, to samajh jao scam ho sakta hai.

11. Agar Business Loan Liya Aur Loss Ke Baad Court Settlement Hua To Score Badhega Ya Nahi?

Ye ek real-life situation hai jo bohot log face karte hain.

👉 Scenario:

Business loan liya → loss hua → repay nahi kar paaye → court settlement karke closure kiya.

👉 Credit Score Impact:

Settlement ko “Settled” status ke saath credit report me likha jaata hai.

Ye status lenders ke liye negative signal hota hai, kyunki pura paisa repay nahi hua.

Is wajah se score immediately high nahi hota.

👉 Kaise Sudhaarein?

Settlement ke baad naye debts responsibly manage karo.

Small secured credit card lo (FD ke against), timely repay karo.

1–2 saal tak consistent positive history maintain karoge to “settled” entry ka impact dheere dheere kam ho jaayega.

12. Final Action Plan.

Free credit report check karo

Payment 100% time par karo

30% se kam utilization rakho

Debt systematic way me clear karo

Galtiyan dispute karke fix karo

Purane accounts active rakho

“Credit repair” scams se bacho

Agar settlement hua hai to fresh positive history build karo

Credit score girna common hai, lekin usko upar lana possible hai.

Magic formula:Timely payment + low utilization + debt clearance + patience

- Click here to explore more helpful articles like this.